average property tax in france

Medium Sized French Towns. In most countries property tax refers to.

Pin On Westward Advisors Group

The Wealth tax kicks in for French households whose combined worldwide assets are valued at more than 1 300 000 Euros on 1st January 2022.

. The percentages and the average house prices are calculated on the basis of the number of houses in Franimo per region or department. Taxe dhabitation is a residence tax. The rate is 509 580 for real estate located in France variable according to where it is located and 5 for real.

There is no exemption. For properties less than 5 years old stamp duty is 07 plus VAT at 20. This tax is actually comprised of the.

For property tax on the earnings from the sale of properties in France rates are set to 19 for all EU citizens and 3333 otherwise. One of the most important is property tax. In this handy guide well help you get up to speed on the ins and outs of paying property tax in France in 20212022.

Buyers in Paris will have to pay stamp duties on the purchase according to Jessica Duterlay a tax associate at Attorney-Counsel a law firm with offices in the UK. The rate of stamp duty varies slightly between the departments of France and significantly depending on the age of the property. The figure is based on the rental value of the property and the rate of tax is determined annually by the authority.

Apartments for Ile-de-France. Exemption Thresholds 2022 2021 Income In practice only 44 of inhabitants in France pay any income tax at all. The same applies to French residents who rent out property abroad.

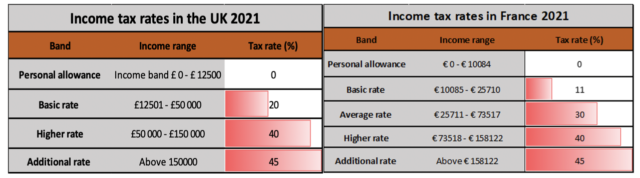

If you are renting out a French property the net income will be taxed at the scale rates of income tax ranging from 11 for income over 10084 to 45 income over 158122 in 2021 plus 172 social charges. This is payable at the end of each year in December and can also be paid monthly. The first-year reduction of 30 per cent applies to.

In 2020 the FNAIM Frances National Association of Estate Agents reported average national house prices of 2276 per square metre. Any owner of real estate in France on 1 st January of the taxation year must pay the property tax during the last quarter of the same year after receipt of his tax. Real estate assets whose net worth on January 1 is less than this amount is therefore not subject.

The basis of tax is the price if the real estate is transferred against payment and the market value in other cases. The amount of registration fees included is 580 of the purchase price and in some departments 509. Monthly Charges Charges Mensuelles.

Property prices in Jura 2022. At the moment two separate taxes are levied on every French residential property Taxe Fonciere and Taxe dHabitation. Average house prices vary dramatically depending on the regionfrom 80000 in more isolated rural areas to over 400000 along the Côte dAzurand they are steadily increasing year upon year.

These include a departmental tax usually 45 of the purchase price as well as a communal tax at the rate of 120 and another government charge of 237. Water sewerage electric and gas 16250. In the case of the purchase of an old property the total transfer of ownership costs and taxes payable for the purchase of an existing property is between 7 and 10 of the purchase price excluding real estate agency fees.

Here is how it is calculated. If you own a French apartment you will have monthly charges for the maintenance of the building elevator etc it all depends on the building you live in and you are typically billed every 3 months. Sometimes these charges will include heating of your water and your apartment so make sure you find out.

What is property tax in France¹. The standard TVA rate in France is 20. French property tax for dummies.

Depending on when you purchase a property in France and your personal circumstances you may benefit from the French governments plans to phase out of the taxe dhabitation which began in January 2018. There are various tax regimes for French rental. This is a land tax and and is always paid by whoever owns the property on January 1st of any given fiscal year.

Consult prices in Paris and Ile-de-France for apartments and old houses. So 56 of inhabitants pay no income tax. Email your questions to editors.

Taxes on goods and services VAT in France. Taxe sur la valeur ajoutée or TVA VAT in French is a tax on certain goods and services which is included in the sale price. Non-residents of France may also have a wealth tax liability but only on their French property assets.

For properties more than 5 years old stamp duty is 58 or 509 in some departments. Property prices in Île-de-France 2022. Any person living abroad and owner of real estate in France is subject to French property tax.

Property owners in France have two types of annual tax to pay. Mandatory property insurance 2642. For French non-residents taxes will usually be taken on France-sourced incomes at a 30 tax rate.

Currently Taxe dHabitation is charged to whoever is living in the property. In a separate study carried out by the notaires in collaboration with the French urban renewal agency ANCT Agence nationale de la cohésion des territoires the authors point to the improved performance of the housing market in 222 small to median sized towns of France stating that the resurgence of. Only around 14 pay at the rate of 30 and less than 1 pay at the rate of 45.

So lets get started. You have to pay this tax if you own a property and live in it yourself have it available for your use or rent it out on. Property prices in Landes 2022.

However there are reduced French TVA rates for certain pharmaceuticals public transport hotels restaurants and tickets to sportingcultural events. Taxe foncière is a land tax and is paid by the owner of the property regardless of whether they occupy the property or whether the property is a second home or primary residence. Property prices per sqm in Paris.

Tax Day Or Tax Everyday Infographic Tax Day Budgeting Finances Infographic

Uk And Ireland Impose Highest Taxes On Inheritance Of All Major Economies Uhy Internationaluhy International

Income Tax In The Uk And France Compared Frenchentree

Property Taxes Property Tax Analysis Tax Foundation

What Could A New System For Taxing Multinationals Look Like The Economist

How Do Taxes Affect Income Inequality Tax Policy Center

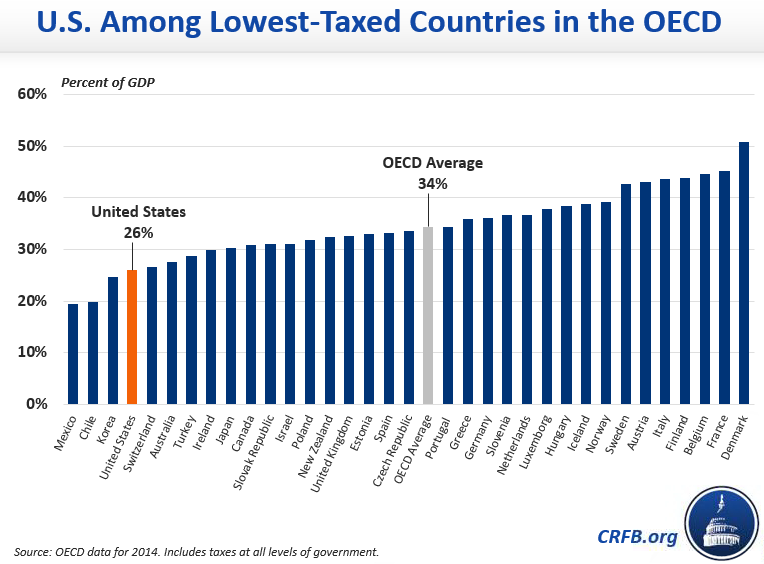

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

France Tax Income Taxes In France Tax Foundation

Average Appraisal Is Half Of A Percent Less Than Expected Rocket Mortgage Press Room Quicken Loans Home Refinance Home Appraisal

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Explore Our Sample Of Office Moving Budget Template For Free Spreadsheet Template Report Template Computer Maintenance

Chart That Tells A Story Average Income Tax Rates Financial Times

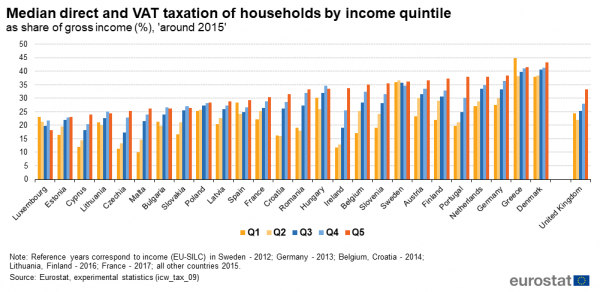

Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

An Overview Of The Taxation Of Residential Property Is It A Good Idea Public Sector Economics

2022 Capital Gains Tax Rates In Europe Tax Foundation